st louis county mn sales tax

Louis County is known for its spectacular natural beauty lakes and trout streams. Louis County does not charge sales tax on tax-forfeited land sales.

St Louis County Minnesota Public Records Directory

Auctions may extend if bids are placed within 5 minutes of closing.

. Louis County local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc. Online auction continues July 27 through August 24 2022 at 1100 am. The most populous zip code in St.

Louis County Minnesota is 55811. Rates include state county and city taxes. If you need access to a database of all Minnesota local sales tax rates visit the sales tax data page.

Saint Louis Park MN Sales Tax Rate. Mail payment and Property Tax Statement coupon to. Mn Sales Tax information registration support.

Louis County Courthouse in Virginia and the following Monday November 29 at the Government Services Center-Duluth. 2200 Nevada Avenue S Unit 222 Saint Louis Park MN 55426 1228 square foot 2 bedrooms bathrooms asking price of 184900 MLS ID 6238811. Did South Dakota v.

This is the total of state county and city sales tax rates. Shakopee MN Sales Tax Rate. All contractors or sub-contractors must carry liability insurance and meet Minnesota Workers Compensation Law requirements.

Louis County Sales Tax is collected by the merchant on all qualifying sales made within St. The minimum combined 2022 sales tax rate for St Louis Park Minnesota is 753. The County sales tax rate is 015.

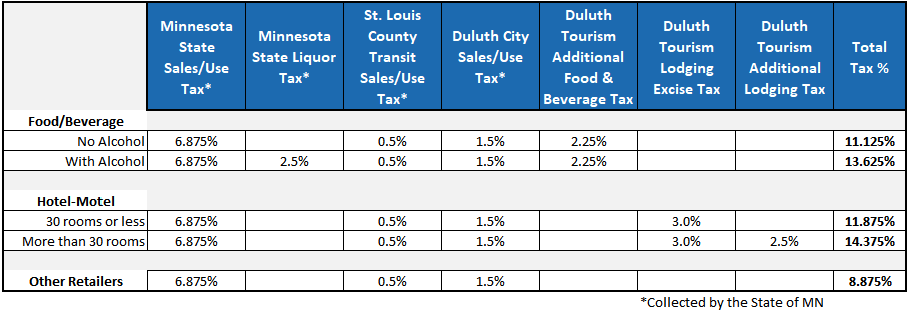

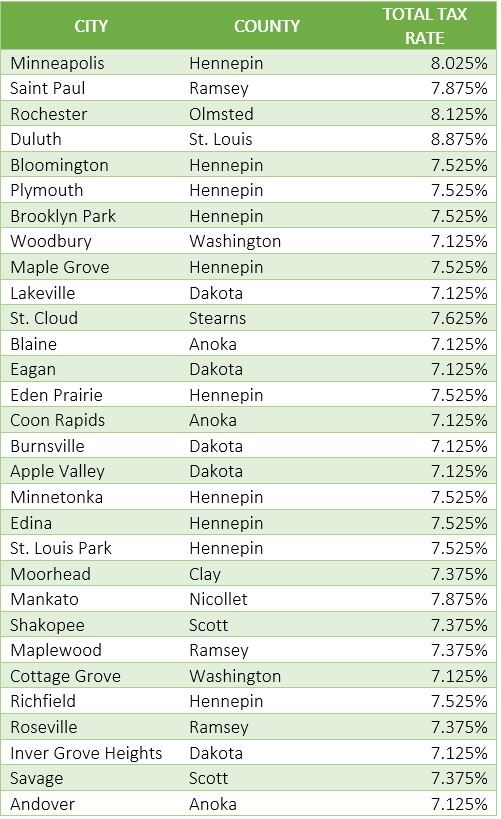

Louis County Missouri - St. Louis County is the largest county east of the Mississippi River. As far as all cities towns and locations go the place with the highest sales tax rate is Duluth and the place with the lowest sales tax rate is Nett Lake.

May 15th - 1st Half Agricultural Property Taxes are due. Additional methods of paying property taxes can be found at. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc.

You can find more tax rates and allowances for Saint Louis County and Minnesota in the 2022 Minnesota Tax Tables. Minnesota has 231 cities counties and special districts that collect a local sales tax in addition to the Minnesota state sales taxClick any locality for a full breakdown of local property taxes or visit our Minnesota sales tax calculator to lookup local rates by zip code. 2020 rates included for use while preparing your income tax deduction.

Look up your taxes. Louis County Land Sales. A Certificate of Liability Insurance must be submitted and updated yearly to.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2 2014 County Board File No. Continuous Online Land Sale Auction.

Sales Tax Calculator. Louis County Sales Tax is collected by the merchant on all qualifying sales made. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St.

This is the total of state and county sales tax rates. Information on timber sales on state tax forfeited land. The one with the highest sales tax rate is 55802 and the one with the lowest sales tax rate is 55772.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. Located in the arrowhead region of Northeastern Minnesota St. The St Louis Park sales tax rate is 0.

Instructions on how to make this change can be found here. The Minnesota sales tax rate is currently 688. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

The latest sales tax rates for cities in Minnesota MN state. Complete Policy Manual of the St. The 2018 United States Supreme Court decision in South Dakota v.

The current total local sales tax rate in Saint Louis County MN is 7375. The total sales tax rate in any given location can be broken down into state county city and special district rates. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05.

This table shows the total sales tax rates for all cities and towns in St. Be on Monday November 22 at the St. Below are some tools to help you find property information that you may be looking for.

The St Louis County sales tax rate is. The West Building provides 69 units of. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The transit use tax applies to taxable items used in the County if the local sales tax was not paid. Ad New State Sales Tax Registration. West Coon Rapids MN.

The Minnesota state sales tax rate is currently. Minnesota has a 6875 sales tax and St Louis County collects an additional NA so the minimum sales tax rate in St Louis County is 6875 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in St. Online payments can also be made on a PC or by calling 1-844-842-6355.

Saint Paul MN Sales Tax Rate. Continuous Online Auction Book. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in.

The December 2020 total local sales tax rate was also 7375. What is the sales tax rate in St Louis County. Saint Louis County Sales Tax Rates for 2022.

Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes. The ability to pay property taxes through a mobile device is currently not functioning unless your mobile browser is set to the Desktop Site view setting option. This 05 percent transit tax applies to retail sales made within St.

November 15th - 2nd Half Agricultural Property Taxes are due. Louis County Courthouse 100.

St Louis County Land Sale Home Facebook

St Louis County Appraisers Resume Interior Inspections Duluth News Tribune News Weather And Sports From Duluth Minnesota

File Your Taxes For Free Human Development Centerhuman Development Center

St Louis County Land Sale Home Facebook

Economic Development Plan Slc Mn

Minnesota Sales Tax Rates By City County 2022

Collector Of Revenue St Louis County Website

Minnesota Sales And Use Tax Audit Guide

Hennepin County Mn Property Tax Calculator Smartasset

St Louis County Land Sale Home Facebook

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota